Most people lodge their tax return each year. The Australian income year ends on June 30 — tax returns cover the financial year and not the calendar year.

Unless you use a registered tax agent, you have to prepare and lodge your tax return for the previous income year from July 1 to October 31.

Lodge a paper tax return

You can download the Tax return for individuals 2018 (NAT 2541) in PDF, 348KB to lodge your paper tax return by mail.

You may also need to download the Individual tax return instructions 2018 in PDF, 1.49MB. These instructions will help you to complete the Tax return for individuals 2018.

Registered agents can order a paper copy through the ATO Publication Ordering Service.

Note: Most refunds are issued within 50 business days of lodgment.

Lodge online with myTax

Lodging a tax return online is for individuals who want to do it on their own, including sole traders. MyTax is the easy, quick, and secure way to lodge your tax return online. You can do it at your convenience as it’s available 24/7 and you can get your refund faster within two weeks.

You don’t need to download anything as myTax is web-based so you can lodge using your computer, smartphone, or tablet.

You’ll have a quicker and easier experience as most information from your employer, bank, and government agencies will be pre-filled by early August. You can also upload your myDeductions data to pre-fill your tax return.

Once you have lodged your return with myTax, a receipt will be emailed to you confirming lodgment has been received.

Note: myTax is accessed through myGov. You can print and review your tax return before you lodge and see a detailed breakdown of your estimated refund or debt.

Lodge with a registered tax agent

You can use a registered tax agent to prepare and lodge your tax return for you. They are the only people allowed to charge a fee to prepare and lodge your tax return.

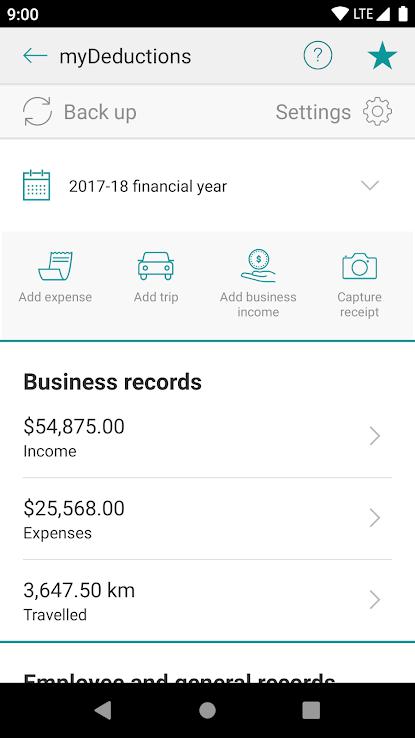

You will need to organise all your required tax records to take to your tax agent appointment. Keep these records and share these with your tax agent using the ATO app’s myDeductions record-keeping tool.

This record-keeping tool allows individuals and sole traders to keep track of general, work-related, and sole-trader deductions (and business income) in one place during the income year. You can then email it to your tax agent.

Download the ATO app for iOS or Android.

How To Lodge My Tax Return? Share on XChoosing an agent

You can find a tax agent (must be registered) or check whether an agent is registered by visiting the Tax Practitioners Board (TPB) website.

Using a registered tax agent provides consumer protection as the TPB ensures they:

- meet and maintain the required standard or qualifications and experience

- comply with the Code of Professional Conduct

Note: When choosing an agent, you should discuss the service to be provided so you both know what to expect.

Due dates for lodging tax returns

Most registered tax agents have a special lodgment program and can lodge returns for their clients after the usual October 31 deadline. The due date will also depend on your personal situation. Contact your tax agent for advice.

If you’re using a tax agent for the first time, or using a different tax agent, you need to contact them before October 31 to take advantage of their lodgment program due dates.

It’s important to get up to date as soon as possible if you haven’t lodged a previous year’s tax return to avoid penalty.

Instant cash loans from Quickle

It can be tempting to spend your tax return on a shopping spree or a holiday. Although this can be an opportunity for Australians to contribute their tax refund towards paying off bills or getting on top of credit debt.

If you have acquired a loan, having your tax return can really help you pay off your small cash loans or personal loans.

Quickle is the trusted name in small, personal, or instant cash loans. Clients have been raving about the simplicity of Quickle’s application process. It’s quick. It’s non-invasive. It’s easy!

If you need cash and you can afford to repay the loan, apply here so Quickle can lend you a hand with your financial needs.